SpareBank 1 Mobile Banking

Description of SpareBank 1 Mobile Banking

SpareBank 1 Mobile Banking is a financial application that provides users with convenient access to a range of banking and insurance services on the go. This app, widely recognized for its user-friendly interface, is available for the Android platform, allowing users to easily manage their financial activities anytime and anywhere. Those interested can download SpareBank 1 Mobile Banking to streamline their daily banking tasks.

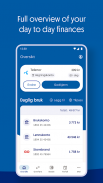

The application offers comprehensive control over various financial accounts, including checking and savings accounts. Users can monitor their account balances, view transaction history, and track spending patterns directly from their mobile devices. This feature provides a straightforward way to maintain awareness of one's financial situation without needing to visit a physical bank.

Managing cards is another essential function of SpareBank 1 Mobile Banking. Users can view their debit and credit card details, including transaction summaries and available credit limits. The app also allows users to manage card settings, such as enabling or disabling cards, ensuring security and convenience in everyday transactions.

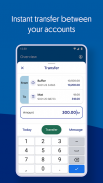

Payments can be made effortlessly through the app. Users have the ability to transfer money between their own accounts or send funds to other individuals. The interface simplifies the payment process, making it easy to enter amounts and select recipients. Additionally, users can set up recurring payments or direct debits, further automating their financial responsibilities.

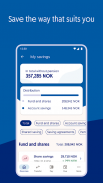

Savings management is an important aspect of the app. Users can create savings goals, monitor their progress, and make adjustments as needed. This feature encourages users to engage with their savings habits and work towards achieving specific financial targets.

For those who have taken out loans, SpareBank 1 Mobile Banking provides the means to manage loan accounts effectively. Users can view loan details, such as outstanding balances and payment schedules. This transparency helps users stay informed about their financial commitments and plan accordingly.

Insurance policies are also integrated into the app. Users can access information regarding their insurance coverage, including policy details and premium payments. The app includes a feature for filing insurance claims, making it easier for users to report incidents and track the status of their claims.

Travel insurance is another useful component of SpareBank 1 Mobile Banking. Users can access their travel insurance card directly from the app, providing essential information while traveling. This feature ensures that users have the necessary documentation readily available in case of emergencies or medical needs while abroad.

Communication with SpareBank 1 is seamless through the app. Users can contact customer service directly, ensuring that any inquiries or issues can be addressed promptly. This direct line of communication is particularly beneficial for users who may need assistance with their accounts or services.

The app requires activation through BankID, a secure identification method widely used in Norway. Once activated, users can sign in using a self-created PIN or fingerprint, enhancing security while maintaining ease of access.

SpareBank 1 Mobile Banking is designed with user feedback in mind. The developers actively seek comments and suggestions to improve the app continuously. This commitment to user experience ensures that the app evolves to meet the changing needs of its customers.

The app also plans to introduce new services throughout the year, keeping the offerings fresh and relevant. Users can expect updates that enhance their banking experience, making it easier to manage their finances in an ever-changing digital landscape.

With its robust set of features, SpareBank 1 Mobile Banking stands out as a practical tool for managing personal finances. It provides a centralized platform for users to oversee their banking and insurance needs, all from the convenience of their mobile devices.

Those who are not currently customers of SpareBank 1 can easily reach out for more information through the bank's website. The app aims to attract new users by demonstrating the value of its services and the convenience it provides.

In summary, SpareBank 1 Mobile Banking is a comprehensive application that addresses the needs of its users by offering a variety of financial management tools. From monitoring accounts and making payments to managing loans and insurance, the app serves as a one-stop solution for banking on the go. Its focus on user experience and ongoing development ensures that it remains a relevant and effective tool for personal finance management.

For more information, you can contact SpareBank 1 through their website at www.sparebank1.no.